Your pipes are your lifeline for the water in your home. Look out for these 6 signs that your water line needs repairing. Lack of Pressure Low water pressure can be caused by a variety of things. Your water heater may be the source of your woes. Aging pipes can corrode, thereby constricting the water […]

Month: May 2018

The Art of Natural Building

The Art of Natural Building is the encyclopedia of natural building for non-professionals as well as architects and designers. From straw bale and cob, to recycled concrete and salvaged materials, this anthology of articles from leaders in the field focuses on both the practical and the esthetic concerns of ecological building designs and techniques. Includes […]

The Gift of Fear

I am a fan of Gavin De Becker’s work, and this is (in my opinion) his best work. He uses The Gift of Fear to further his argument that fear is necessary for survival, and that, in our “safe” modern world, we ignore our gut. He posits that women’s intuition, uneasy feelings, a man’s gut […]

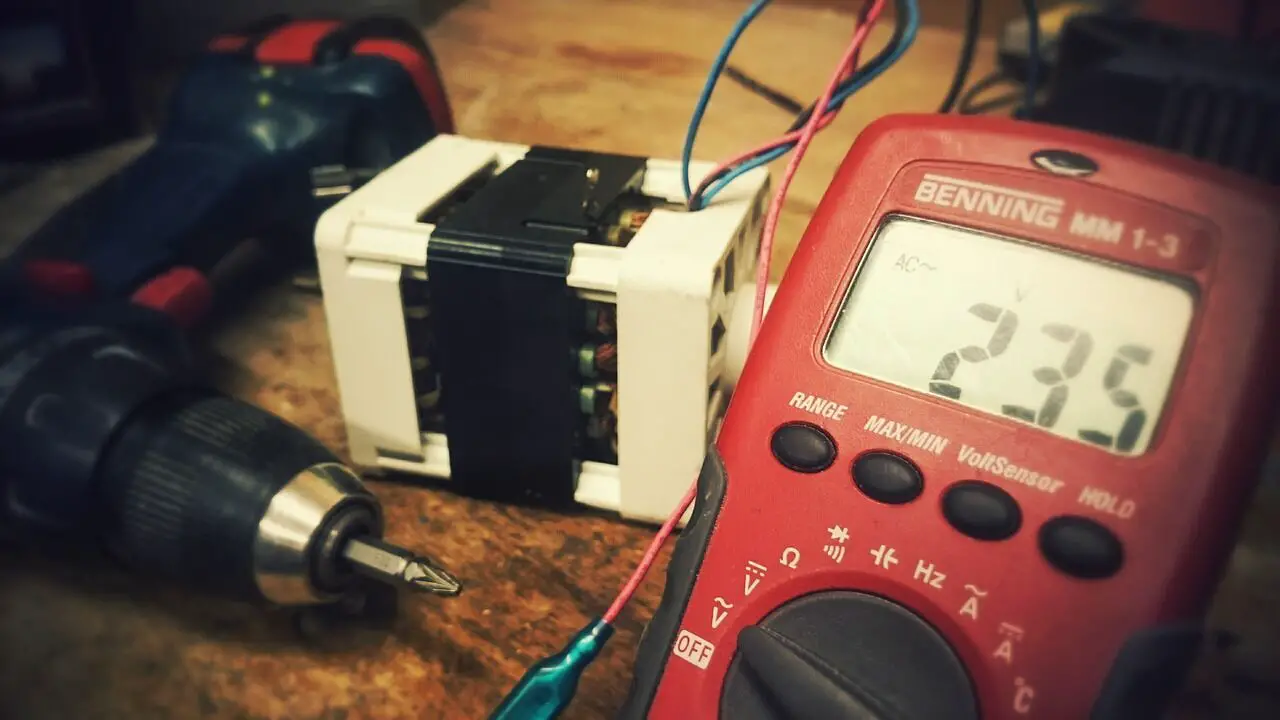

Everything You Need to Know about a Multimeter

When I start thinking about what device is the most useful to have for electrical needs around the house, a multimeter definitely is one of the most versatile. You can use it both in your home and on your vehicle to determine different electronic components. If you’re trying to determine if a fuse is blown, […]

5 Tips to Improve Your Finances: A Mini Guide

Personal finance management is something that we don’t learn since our childhood, nor is it taught in schools. But it is something that we must learn as soon as we start growing up, as it is something we have to deal with all our lives! Here are a few simple tips that will hopefully guide […]